Strategy blog: Inflation, waiting for the peak

Victor Balfour, Global Investment Strategist

If the recent raft of February CPI prints are anything to go by, inflationary pressures were still building before Russia’s attack on Ukraine.

It had been widely assumed that headline inflation rates would likely peak around the turn of the year in the eurozone and the US – and somewhat belatedly in the spring for the UK (once the energy cap was lifted). The belief was that commodity base effects would start to roll over and goods pricing pressures would subside as bottlenecks eased and patterns of expenditure shifted back towards services.

As the February data suggest, this assumption of an imminent peak – like earlier similar assumptions made during 2021 – was already looking premature, even before the invasion. Now, with the Bloomberg commodity price index up a further 13% since mid-February (led by oil and natural gas), it seems clear that the peak will be even later, and higher, than previously expected.

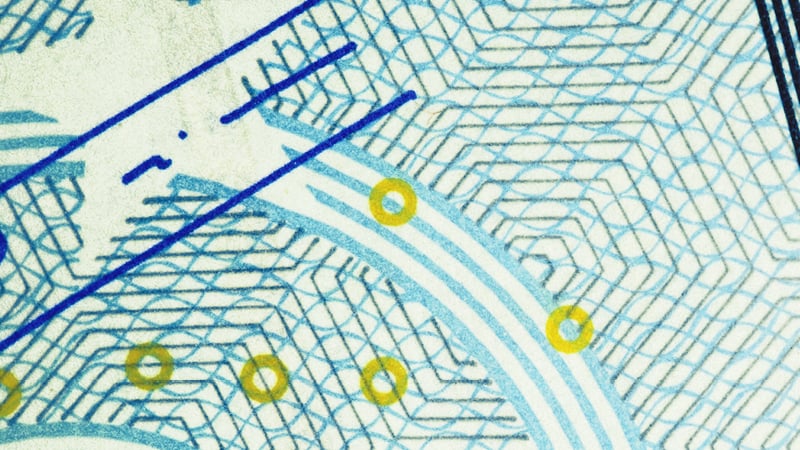

Headline consumer price indices (harmonised, y/y %)

One estimate suggests that the direct arithmetic effect of today’s oil and gas prices on US and EZ consumer prices will be to add another one to two percentage points to headline US and eurozone CPIs.

Those base effects will still be making themselves felt, but the end-year inflation rates might now be close 7% and 4%, respectively, all things being equal – possibly even higher given the upward momentum in those oil prices. These are just the direct effects. The visible direct energy components of the CPI include categories such as liquid fuels, gas and electricity, and account for 7% of the US basket (11% in EZ and 7% in the UK). But indirect channels also play a big part, albeit with some lag. Higher production costs affect core inflation, while the second order effects of rising inflation expectations can shape wages and the cost of capital. The thorny business of disentangling and estimating the magnitude of such forces is more art than science.

It’s clearly hard to be precise about the peak. While we don’t expect inflation to continue to accelerate once energy (and wider commodity) prices have peaked - there is still a big transitory component to this inflation surge - the likely deceleration will not be as quick as previously expected.

Disclaimer

This content is produced by Rothschild & Co Wealth Management UK Limited, Rothschild & Co Bank AG and Rothschild & Co Vermögensverwaltung GmbH for information and marketing purposes only. Save as specifically agreed in writing by the Bank, it must not be copied, reproduced, distributed or passed, in whole or part, to any other person. The content of this document does not constitute a personal recommendation or an offer or invitation to buy or sell financial instruments. Nothing in this document constitutes legal, accounting or tax advice. Although the information and data herein are obtained from sources believed to be reliable, no representation or warranty, expressed or implied, is or will be made and, save in the case of fraud, no responsibility or liability is or will be accepted by the Bank as to or in relation to the fairness, accuracy or completeness of this document or the information forming the basis of this document or for any reliance placed on this document by any person whatsoever. No representation or warranty is given as to the achievement or reasonableness of any future projections, targets, estimates or forecasts contained in this document.

Furthermore, all opinions and data used in this document are subject to change without prior notice. Laws or other regulations may restrict the distribution of this document in certain jurisdictions. Accordingly, recipients should inform themselves about and observe all applicable laws and regulations. Neither this document nor any copy thereof may be sent to or taken into the United States or distributed in the United States or to a US person. Rothschild & Co Bank AG's registered office is at Zollikerstrasse 181, 8034 Zurich, Switzerland. It is authorised and regulated by the Swiss Financial Market Supervisory Authority (FINMA).