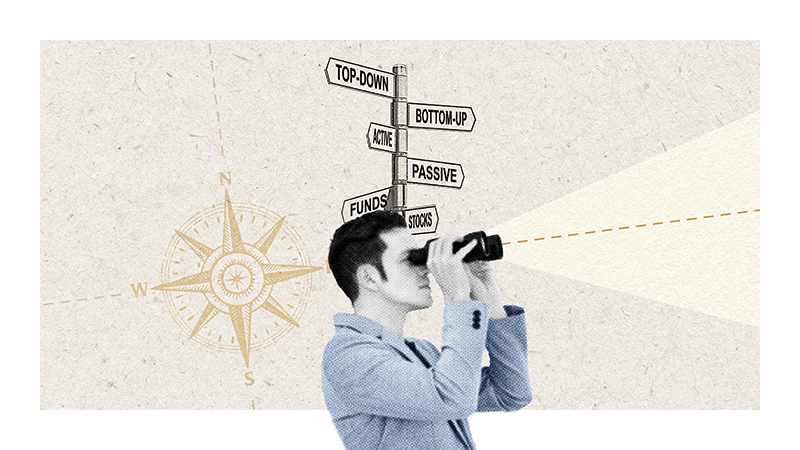

Our investment approach

Our objective is to preserve and grow the wealth of our clients over multiple generations. Through our investments, we aspire to preserve both the wealth of future generations and the environment and society they will inherit.