Growth Equity Update

July 2024 – Edition 28

- Venture capital firm fundraising – improving conditions: Pitchbook data suggests the VC industry has raised $80.5bn from LPs in H1 2024, on track for $161bn for the full year 2024, which would be the lowest amount raised since the $119bn of 2015. Q2 VC funding was though US$50.1bn, up 65% on Q1’s $30.4bn and in July there have already been notable raises by Index Ventures ($2.3bn) and Flagship Pioneering ($3.6bn).

- Deal making picks up: The R&Co Deal Monitor shows H1 2024 European VC deal value to be up c36% yoy at $17.7bn. Initial findings from Pitchbook suggest the Q2 US VC deal total of $55.6bn was up 57% yoy and was the highest quarterly total for two years.

- Enthusiasm for Artificial Intelligence boosting venture markets: The booming interest in the potential of AI is providing a fillip to the venture capital market overall. AI and related businesses took four of the top six US venture deals in H1 2024 - Vantage Data Centres ($9.2bn), xAI ($6bn), CoreWeave ($1.1bn), Scale AI ($1bn). The largest European deal in H1 was in AI, Wayve’s $1.05bn.

- Softbank - Back on Offense: Expressing its shift from defense to offense SoftBank CEO Masayoshi Son observed at the company’s June AGM that it will ‘look for our next big bet, without fear of whether it’ll be a hit or miss’ and that Softbank’s past investments in Alibaba and Arm Holdings will look like ‘a warm up for my great dream to realize artificial superintelligence.’

- Closing in on US rate cuts: After June’s 3% inflation the market is pricing c100% certainty of a 25bps September rate cut and another 25bps cut by year end, potentially boosting H2 sentiment.

- ‘Life must be lived forwards, but can only be understood backwards.’ Soren Kierkegaard: At the year’s half way stage, we review the progress of our predictions for venture capital in 2024.

Click here to download a PDF version of Growth Equity Update

VC firm fundraising – onto the front foot

VC fundraising – a stronger Q2 and a good start to July

The statistics for global venture capital firm fundraising continue to look relatively downbeat. Recent Pitchbook data suggests that globally the industry has raised $80.5bn from LPs in H1 2024 with a fund count of 632. Ostensibly this puts the industry on track to raise $161bn for the full year 2024, which compares with $196bn in 2023 and the peak of $380bn in 2021. A total of $161bn would be the lowest amount raised since the $119bn of 2015.

Average fund size has risen substantially, with the relatively few new investment vehicles suggesting that funds are being concentrated with larger players.

Global VC Fundraising activity – Capital raised and fund count

Tone firming up: This apparently downbeat message appears, however, to belie an underlying pick up in market conditions. The mood amongst VC funds, and their fundraising, appears to have picked up in the last few months, bolstered by the surge in interest and appetite for AI-related investments. After a particularly poor Q1 global fundraising had been on track to reach just $121bn in 2024. By the end of Q2 it is on track for $161bn, a sharp pick up. Q2 VC funding was US$50.1bn, up 65% on Q1’s $30.4bn

A flurry of recent fund raising announcements: Recent announcements by big venture funds suggest conditions in the market are improving. In early July Index Ventures announced that it had raised $2.3bn for a new fund, with $800m to be devoted to early stage venture funds and $1.5bn to growth and late stage companies. The fund size compares favourably with its predecessors – at the peak of the market in 2021 Index raised $900m for Index Ventures XI and $2bn for an associated growth fund, Index Ventures Growth VI. Index reports few problems in raising the funds. San Francisco based partner Nina Achadjian commented:

“We’re in a really fortunate situation where our funds were raised in a few weeks from existing LPs mainly, and we’re really oversubscribed.”

The firm observed that the smaller size of growth rounds compared to 2021 meant it did not have to raise at the same scale as 2021 to access a similar level of opportunity. Unsurprisingly Index, which was an early investor in Mistral and ScaleAI, is enthusiastic about the potential for AI. Speaking of the platform shift created by the arrival of AI Hannah Seal, an Index partner commented:

“We’re just beginning to see where AI can make a difference. That’s why this is so timely because this is the point at which we really see AI, especially in the application layer, starting to come to fruition.”

In April Andreessen Horowitz raised a$7.2bn fund with $3.75bn to be devoted to growth equity and late stage businesses and a dedicated $2.25bn to be devoted towards AI. Of this latter figure $1.25bn is to be targeted at companies that build AI infrastructure and $1bn towards companies developing AI applications. The balance of the funds will be targeted at Games ($600m) and American Dynamism (also $600m), the latter targeting ‘founders and companies that support the national interest’ in areas like aerospace, defence, education and housing. The fund size, which was initially targeted at $6.9bn, exceeded expectations.

Also in April Norwest Venture Partners raised its 17th fund at $3bn, the same size of raise as its previous fund at the height of the market in December 2021. The company will focus on enterprise software, consumer and healthcare. In May TCV raised $3bn for its 12th fund, described at the time as the largest technology focused venture fund to close in 2024. TCV observes that a better valuation environment in technology and less competition makes VC investing more attractive:

Technology investing is always competitive. That being said, the irrational behaviour we saw really ratchet up in 2021 has gone. We saw hedge funds and venture capitalists try their hand at growth investing and they are largely gone.”

Kleiner Perkins, an early investor in Google, Amazon and DoorDash as well as more recent AI investments like Harvey (legal AI), Together AI (cloud platform) and Glean (enterprise software) announced at the end of June a $2bn raise. The funds will be split $1.2bn for its latest opportunity vehicle KP Select III, to back high inflection investments, and $825m for KP21, the firm’s largest flagship early-stage fund to date. The firm is convinced of the opportunities presented by AI. Announcing the funds the Kleiner Perkins team commented:

“We believe that we are on the brink of remarkable technology shifts that will transform industries, amplify the power of human ingenuity, and generate significant economic growth. Artificial intelligence has emerged as a fundamental technology that’s catalyzing this transformation and, much like electricity, it’s poised to impact every aspect of our lives – from personal experiences and healthcare, to how we work and how companies are built across all industries. With these new funds, our team’s focus on enterprise software, consumer, healthcare, fintech and hardtech, remains the same. Each domain will be accelerated tremendously by AI.”

In early July Flagship Pioneering, a specialist life sciences venture capital company raised $3.6 billion in new funding ‘to support the creation and development of an estimated 25 breakthrough companies in human health, sustainability, and artificial intelligence.’

In May Accel raised a $650m fund in Europe with a focus on cybersecurity, enterprise software and AI. Meanwhile press reports suggest that General Catalyst is close to raising around $6bn which would be its largest fund to date, exceeding the $4.6bn Fund XI which closed in 2022.

SoftBank - Fearlessly looking for its next big bet: This new phase of optimism is perhaps best expressed by the swing in mood at Softbank which, after the sharp fall in VC markets from their November 2021 peak, spent most of 2022 wedded to its policy of ‘defense.’ New and follow on investments in the SVF1+2 funds were just $3.1bn in 2022 (and $2.2bn of that was in Q1), down 93% from the $44.3bn of FY21.

Having stabilised the business in FY22 Softbank then looked to a greater balance between ‘Defense and Offense’ in 2023. At mid-year 2023 CFO Yoshimitsu Goto observed that ‘Even though we see signs of improvement in the last three months, we can’t simply restart investments’ albeit he also noted that:

“Since we founded our company, we wanted to make people happy through the information revolution and since we founded Vision Fund, what was our vision? AI. [The] AI revolution has always been a part of our vision, and from that perspective, we want to identify and invest in opportunities and a lot of things are evolving now, especially visible recently is Generative AI, which has been growing exponentially.”

Mirroring the AI inspired upswing in market mood Softbank has entered in 2024 in a new phase of optimism around AI investment. SoftBank led the $1.05bn raise by autonomous driving business Wayve, the largest European AI deal to date, at the end of May.

In June 2024 , at the company’s AGM, CEO Masayoshi Son observed that Softbank’s past investments in the likes of Alibaba and Arm Holdings would look like ‘a warm up for my great dream to realize artificial superintelligence.’ He highlighted AI, semiconductors, autonomous driving, data centres and robotics as key areas for potential investment.

The company rejected an alternate proposal from Elliott Management that it should instead launch a $15bn buyback with Softbank CFO Yoshimitsu Goto stressing instead that new AI investments are a preferred route. ‘We believe this is a time when new investment activity should be taking place that will be the basis for the future growth of SoftBank Group. From now on, we want to step up investments in AI companies.’

Expressing his new mood of confidence and the now total shift from defense Masayoshi Son told its AGM that SoftBank will ‘look for our next big bet, without fear of whether it’ll be a hit or miss’ outlining that that ‘This is what I was born to do, to realise ASI -artificial superintelligence’ – technology smarter than humans.

Growth Equity Markets at the 2024 half way point

Life must be lived forwards, but can only be understood backwards.”

In the January Growth Equity Update we made ten predictions for the Growth Equity market in 2024. At this half way stage of the year we review them.

Put briefly three characteristics have come to the fore in H1 2024.

The levels of VC investment have picked up: Our Deal Monitor shows that in European VC the total amounts raised for VC backed companies each month exceeded the equivalent 2023 month. In total our Deal Monitor shows H1 2024 deal value to be up c36% yoy. Initial findings from Pitchbook suggest that the Q2 US VC fundraising total of an estimated $55.6bn was up 57% yoy and represented the highest quarterly total for two years.

Artificial Intelligence has surged: The leading category for US raises in H1 2024 has been Artificial Intelligence with three $1bn plus raises and a strong flow of smaller raises. Associated areas – the picks and shovels of the AI gold rush – categories like data centres to power AI and semiconductors have also seen a sharp upturn in fundraising. Europe’s largest raise in H1 was for the AI powered autonomous vehicle software company, Wayve.

Corner turned – a new mood of relative optimism: There is no doubt that raising money for a new VC fund remains tough, that getting funded as a VC company is still an arduous process outside the hot area of AI and the level of exits remains modest. Nevertheless there is a distinct upturn in mood and a shift in sentiment in the VC world – a sense that a corner has been turned and that things get better from here, symbolised perhaps by the return of Softbank onto the offensive. Atomico captured this shift in mood recently saying ‘We haven’t fully washed through the overhang from the peak years but the green shoots are all around us. We are moving beyond the recovery phase and back into a period of growth.’

So a review of how our ten predictions for VC in 2024 are playing out so far:

Artificial intelligence gathers pace: Yes. Perhaps not the boldest of predictions but one that is right so far. We anticipated that investment would widen well beyond LLM providers. LLM providers have attracted the largest deals (xAI in the US, Mistral in Europe ) but with a widening of funding to pick up smaller AI apps based businesses - the likes of RobinAI, Photoroom and Luminance in Europe and Alphasense, Hebbia and Suni in the US.

Momentum behind ClimateTech projects: Yes and no. A geographical split here. Perhaps reflecting the partial backlash against the green lobby in the US, the level of VC funding for climate firms has faltered in the US, falling to the sixth largest category in terms of funds raised in H1 2024. By contrast ClimateTech remained the biggest fundraising category in Europe in H1 with four $200m+ deals – H2GreenSteel, Sunfire, Enviria and Electra- despite these often being pre revenue /pre profit businesses with heavy capital investment required to scale projects.

Funding rounds are slower: Yes. The ‘hot’ market conditions of 2020-22 saw a pressured environment and rapid decision making. Outside of AI, where competitive tension to invest remains high, the environment appears much less pressured. For companies it means funding rounds are more onerous and take longer than they did in the recent past. As TCV founder Jay Hoag commented recently:

“The world has come our way. In 2021, a hedge fund would have a Zoom call and commit to an India deal in the morning, a China deal at lunch and a US deal in the evening. There was no diligence. That’s gone.”

Focus on corporate governance: Yes. A difficult one to demonstrate. Perhaps one way to express this is that recent years have been characterised by high profile governance issues. 2022 saw the collapse of FTX and 2023 saw Binance fined $4.3bn with its founder stepping down. 2023 also saw the demise of Silicon Valley Bank and the issues over control and corporate governance structures at Open AI. As yet 2024 has been free from such major negative governance shocks – expressive perhaps of a more circumspect investment environment.

Company casualties mount: Maybe not. The economy is faring better than expected in 2024, interest rates have peaked and funding has resurged – all potentially offering a lifeline to hard pressed companies. In the US, according to S&P Global Market Intelligence, 34 private equity and venture capital US portfolio companies filed for bankruptcy in the first four months of the year. That is close to the number for the whole year in 2021 and 2022. In 2023 there were a record 103 bankruptcies, meaning this year’s run rate is flat at a high level rather than accelerating.

More down rounds: Yes. Again often a difficult metric to measure as companies avoid rounds when they might have preferred to do them, or raise internal rounds, or keep private the terms of the deals they do. We can reference data from Pitchbook for Q1 2024 in the US. This suggests that the percentage of flat and down rounds in the US has risen steadily since Q1 2022 and reached 27% in Q1 2024, the highest level in a decade. Linked to this has been the rise of more aggressive deal terms with market observers reporting that deal terms designed to protect investors from downside risk or to offer more upside through mechanisms such as liquidation preferences, participating preferred shares and cumulative dividends are now much more common.

Share of VC deals by up, flat, or down rounds by quarter

Q1 2024 saw the proportion of flat and down rounds at its highest point in a decade

Venture capital firms under pressure as well: Yes, but signs of relief . At the start of the year we anticipated a tough time both for fundraising and exits by VCs. Fundraising for VC investors is tough – the Q1 global figure put VC managers on track to raise $121bn in 2024, down from the peak of $555bn in 2021 and $188bn in 2023. Q2 though appears to have seen an upturn in sentiment and some substantial new funds being raised. Q2 VC funding was US$50.1bn, up 65% on Q1’s $30.4bn.

The IPO environment to improve: Yes, but not out of the woods. A fragile recovery for IPOs in H1 2024 with the environment overall probably stronger in Europe than in the US.

In the Americas, there were 86 IPOs in H1 2024 (source EY) raising $17.8bn, up 12% and 67% yoy respectively. As the chart shows EMEIA ( Europe, Middle East, India and Africa) saw a c50%/85% yoy growth in the volume and value of IPO deals led by a surge in European listings and a strong market in India. London saw eight new listings in H1 2024 raising £514m down 13% on H1 2023.

The market remains fragile. Despite its H1 recovery the European IPO market ran out of steam in mid-June with the pulling of the planned luxury goods IPO, Golden Goose, despite initially being described by its bookrunners as multiple times oversubscribed. It suffered the twin effects of modest long only demand and the uncertainty caused by sudden calling of French elections. With summer now underway the test will be to see whether the European IPO market resumes its revival post summer in September.

IPO activity by geography – yoy change %

H1 2024 % change versus H1 2023

M&A revival? Partial. The adaptation to the new normal of higher interest rates plus the hopes – at some point in H2 - of US interest rate cuts, have meant a patchy revival in the M&A market. According to PWC the value of global M&A deals was up 5% yoy in H1 2024 at $1,320bn versus $1,253bn in H1 2023.

Deal volumes in the Americas fell 34% yoy but a series of large transactions in energy and technology meant values increased 29% yoy. In EMEA deal volumes fell 31% yoy but the presence of eight ‘megadeals’ compared to nine in the whole of 2023 meant values rose marginally, by 1% yoy. The continued prospect of interest rate cuts should encourage the market further going into H2.

Deal volumes and values, 2019-H1'24 - Europe

Deal volumes and values, 2019-H1'24 - US

How will the end of 2024 look? Mixed bag: We anticipated

- US interest rates could be 75bps lower according to Fed officials with another 100bps of reduction in prospect for 2025. The current market view is for two interest rate cuts, each of 25bps, this year.

- Venture Capital companies will be two years into the focus on profits and growth, more and more will be turning the corner to demonstrate that profitability is there and looking for funding for renewed growth. The funding has picked up and typically is focused on VC companies that are either profitable or on a visible path to early profitability.

- Public investors may have made some good money on reasonably priced IPOs. This has happened with the crop of IPOs in H1 2024, in both the US and Europe, having generally performed strongly.

- Global economic growth may have slowed modestly in 2024 before reaccelerating in 2025. This looks pretty much on track. At the start of the year we were looking at global GDP growth of 2.7% in 2023 slowing to 2.6% in 2024 and then improving in 2025. The latest KPMG forecasts suggest 2.5% growth in 2024 and a bounce back to 2.7% in 2025.

Public markets – Decent H1

Though commentators remain concerned by its narrow nature, the advance of public markets continued in the first half. To the 28th June the MSCI Global index was up 11.3%. The US led the way, up 14.6% with the Magnificent Seven stocks up 36%, NASDAQ up 20% and the S&P 500 up 15%. In Europe the STOXX 600 was up 7% and the FTSE 100 up 6%.

The outsize contribution of the Magnificent Seven to the global market advance is indicated in the chart.

Global stock market contribution – YTD (% points, USD)

Once again Wall Street strategists have been racing to upgrade their year-end forecasts. The S&P500 index reached 5,460 on June 28 up from 4,742 at the start of the year. The Exhibit shows Wall Street strategists’ start-of-the-year forecasts for the level of the S&P 500 at end 2024. Of the 20 strategists surveyed only 12 saw the index showing any sort of advance in 2024. Of these 11 predicted an advance of less than 10% with just one looking for double digits, Yardeni Research, with an advance of 13%. The average predicted advance was 2%.

Of course these are year-end targets and they may yet come true. The strategists though have, in general, decided to hedge their bets.

By June 28th the S&P 500 had, at 5,460, exceeded all of the Wall Street strategists’ initial targets for the full year. There has been a flurry of upgrading in the last few weeks with the median forecast now rising to 5,500, a 13% increase on the median start year target, albeit offering just 1% upside from the S&P 500 close at the half year.

The highest year end forecast is now that of Evercore whose 6,000 target offers 10% upside from current S&P 500 levels. There are a couple of forecasts (RBC and Ned Davis) that have been raised to 5,700 (+4%) and a clutch ( BMO, Citigroup, Goldman Sachs , UBS) now pitched at 5,600, or 3% upside to the end of the year. The lowest forecast remains that of JP Morgan at 4,200, downside of 23% to the end of the year. A recent shake up in the global equity strategy team at JPM may presage a change in approach.

S&P 500 – The evolution of Wall Street strategists’ 2024 year end targets

Meanwhile hopes of US interest rate cuts appear to be rebounding. US inflation in May came in at 3.3% slightly better than the expected 3.4% and the second month in a row that inflation beat expectations. This was followed by non-farm payroll numbers in early July that suggested the US unemployment rate increased from 4% to 4.1%, its highest level since November 2021, despite job creation of 206,000 being ahead of consensus forecasts of 190,000.

The combination of the inflation and payrolls data was already enough to spark debate about a slowdown in the economy and whether the Fed’s tightening of interest rates has gone on for too long. Then on July 11 the June inflation figure was announced, coming in at 3% . This was better than market predictions of 3.1% and was the lowest monthly inflation number since June 2023. Core CPI, ex food and energy, also beat expectations of 3.4%, coming in at 3.3%.

Fed Chair Jay Powell was cautious in his testimony to the US Senate Banking Committee observing that the April and May inflation numbers ‘have shown further modest progress’ ( since reinforced by the June figure) and that the labour market is ‘not a source of broad inflationary pressure for the economy now.’ He highlighted the Fed’s challenge, avoiding the inflation risk of lowering rates prematurely against the risk of undermining growth by keeping rates high for too long. ‘We’re very much balancing those two risks, and that’s really the essence of what we’re thinking about these days.’

The next Fed meeting is at the end of July. Despite the June inflation number the market does not expect a rate cut at that meeting. Instead it now gives an almost 100% certainty to a 25bps rate cut in September with the expectation of a further 25bps interest rate cut before the year-end.

European rate cuts have preceded those of the US. On June 6 the ECB lowered interest rates for the first time in five years, cutting the core interest rate by 25bps to 3.75%. There had been a 450bps rise between July 2022 and September 2023.

The inflation figures immediately preceding the cut were slightly against trend, higher than expected at 2.6% (April 2.4%) and so the market anticipated that a cut would be made without committing to further future reductions. This duly came about with the ECB indicating that it was ‘not pre-committing to a particular rate path’ with ECB president Christine Lagarde saying that further rate cuts will ‘depend on the data that we receive.’

The head of the Dutch central bank Klaas Knot observed in an interview that a further rate cut is unlikely in July while indicating that ‘The next meeting that will truly be open again will be in September.’ The market has pencilled in two more interest rate cuts by the end of the year which would take rates down to 3.25% and then a further two rate cuts by the end of 2025.

In the UK, albeit down from 3.2% in March, April’s inflation figure at 2.3% was deemed relatively disappointing with forecasters having anticipated 2.1%. The May figure then hit the Bank of England’s target of 2% for the first time since July 2021, helped by lower energy prices. Services inflation though remains high at 5.7% while core inflation, ex food and energy, was at 3.5% in May after 3.9% in April. With energy prices set to rebound the Bank of England expects inflation to rise to 2.6% by the end of the year.

There remains caution around cutting interest rates. Jonathan Haskel, professor of economics at Imperial College and an external member of the MPC observed in early July:

"There are considerable encouraging signs, most notably from normalising inflation expectations and a temporary return of headline inflation to target in May 2024. However, the wage-price system in the UK has been subject to a sequence of enormous shocks over recent years. The playing out of those shocks through the economy, and the continued tight and impaired labour market, means that inflation will remain above target for quite some time. I would rather hold rates until there is more certainty that underlying inflationary pressures have subsided sustainably."

At present markets are anticipating one 25bps UK rate cut by the end of the year.

IPOs – Muted recovery

In June there were two US IPOs that raised more than $400m. These brought the number of such deals to fifteen ytd and, in raising $1.38bn, the ytd total value of such deals to $11.9bn. This compares with nine IPOs raising over $400m during the whole of 2023 with an aggregate value of $14.1bn.

Of the two June IPOs, Tempus AI, which raised $411m, is now down over 20%. The other, Waystar Holding Company which raised $968m, is flat post IPO.

The overall performance of the 2024 cohort remains positive. All but two saw a gain on the first day with the weighted day one advance being 15%. Six of the fifteen IPOs are now trading at below their flotation price but the overall advance of the group is still a weighted 26%.

The IPO window is open. There is a steady flow rather than a flood of IPOs and sponsors still need to be cautious in terms of investor selectivity and pricing discipline. Nevertheless, the IPO market is building an attractive record that suggests it is worth the while of investors to participate. Meanwhile, there is little chance of a shortage of supply with, according to Pitchbook data, the backlog of venture-capital-backed firms waiting for an opportunity to go public standing at around 220 companies.

Rothschild & Co strategist Kevin Gardiner summarises the current key drivers of the market in this graphic:

Major interest rates now starting to fall

Venture Capital – the biggest raises in H1 2024

Our Deal Monitor shows that each month of H1 2024 saw the total amount raised for European VC backed companies exceed that of the equivalent 2023 month. In total our Deal Monitor indicates H1 2024 fundraising to be up c36% yoy at $17.7bn. Initial findings from Pitchbook suggest that the Q2 US VC fundraising total of an estimated $55.6bn was up 57% yoy and represented the highest quarterly total for two years.

H1 2024 saw 49 European raises of $100m plus versus 32 in H1 2023. There were 45 raises of $100m-$499m (vs 32 in H1 2023), three of $500m plus (versus zero) and one of $1bn (versus zero).

These top 49 raises produced just short of $10bn with the top industry categories being Climate Tech ($3bn), AI ($2.3bn), Software ($1bn) and Online Grocery at $0.8bn.

Of the five largest deals in Europe in H1 two, Wayve and Mistral , are in AI; one is a marketplace operator, Travelport; there’s a ClimateTech business, the German Sunfire; and a fintech, UK neobank, Monzo.

Top European VC raises by value H1 2024

In the US we monitor deals of $100m and above. We counted 157 such deals in H1 2024 with funds raised of just over $50bn. The Exhibit outlines all the H1 deals of $250m or more. The 35 such raises were for a total of just over $33bn.

The booming interest in the potential of Artificial Intelligence is providing a fillip to the venture capital market overall. The top end of the list is dominated even more so than in Europe by AI and related deals, taking four of the top six places.

The largest single deal was the $9.2bn of funding arranged for Vantage Data Centres by DigitalBridge Group and Silverlake. A recent report by Morgan Stanley estimated that global Gen AI related demand for power will expand rapidly to hit 224 TWh by 2027, equivalent to Spain's total 2022 power consumption.

In May Elon Musk’s xAI raised $6bn in a deal valuing the company at $18bn. The business was started in July 2023. In November 2023 it launched Grok-1, an AI LLM. The Series B round was supported by investors including Valor Equity Partners, Vy Capital, Andreessen Horowitz, Sequoia Capital, Fidelity Management & Research Company, Prince Alwaleed Bin Talal and Kingdom Holding, amongst others.

In May AI cloud infrastructure business CoreWeave raised $1.1bn in a funding round led by Coatue, with participation from Magnetar Capital, Altimeter Capital, FMR, and Lykos Global Management. The round valued the company at $19bn. Scale AI which helps companies classify, prepare and test data for AI model training. raised a $1bn Series F led by Accel and Y Combinator valuing the business at $13.8bn.

Outside of AI, Generate Capital which works with developers to finance and operate sustainable infrastructure projects, raised $1.5bn from the California State Teachers’ Retirement System in January and the video game and software developer Epic Games raised $1.5bn from Disney in February.

Top 35 US VC raises by value H1 2024

June keeps up the pace

June was a solid month for European venture capital raises. Our Deal Monitor recorded c$2.9bn of venture raises in the month down from $3.4bn in May. The total is up 4% against the June 2023 total and was 42% down versus June 2022 (which, however, was the last big month of 2022). The ytd total for European raises is $17.7bn, up 36% yoy.

Europe - $2.9bn of VC raises in June

The biggest deal in Europe in June was, once again, for an AI business, this time the $640m raised by French LLM business, Mistral. The deal, split $500m in equity and $140m in debt, was led by General Catalyst and valued the year old company at $6bn. It was supported by existing investors including Lightspeed, Andreessen Horowitz, Bpifrance, BNP Paribas, Nvidia, Salesforce, Samsung and IBM.

Mistral argues that it is building its LLMs at much lower cost than its US counterparts although it opted to take in extra funding due to investor demand and in order to scale up more quickly. Co-founder Arthur Mensch commented:

“It remains a capital-intensive market. The more computing capacity we have, the more people we can get into our team . . . to break the barriers of artificial intelligence.”

Biggest US VC raises in June ($100m and above) – $14.7bn raised

Our views on the state of the venture capital markets

The combination of global inflation, rising interest rates, and increased geopolitical risk substantially impacted the venture capital market in 2022 and 2023. As we reach the half way point of 2024 adaptation to the ‘new normal’, the refocusing of venture backed companies to achieve a better balance of growth, profitability and cash flow and the prospect of H2 interest rate cuts have led to increased optimism and enthusiasm for growth equity. Our summary of the outlook is:

- The deterioration in the interest rate, inflation and macro-economic environment has had a sharp impact on valuations in private markets. The scale of the fall in the Refinitiv VC index in 2022 was much more substantial than the 33% fall on NASDAQ. This was reflected in some big valuation reductions in some high-profile VC rounds in 2023.

- There is substantial interest in venture capital to fund artificial intelligence, both the foundation LLM models, the applications of AI and industries (data centres, semiconductors) supporting the development of AI.

- Best-in-class companies, addressing critical requirements, continue to attract support. There are still hotspots for investment most notably in Artificial Intelligence and Climate Tech. Certain investors remain very active in the space with substantial funds to deploy.

- The speed of the investment process has slowed considerably. The level of diligence on new deals has stepped up.

- 2023 saw more downrounds, albeit the substantial fund raising of 2021 and the ability of companies to eke out existing resources has limited the number of these. These continue into 2024.

- There is substantial dry powder in the VC industry. This though appears to be prioritised to support existing rather than new investments.

- It seems likely that the more difficult conditions for fundraising, and the lack of a clear path in some cases to early cash positive status, will mean a flurry of venture capital backed businesses looking to sell or merge their businesses.

- Valuation priorities have shifted with investors having moved away from an emphasis on revenue growth and revenue multiple emphasis. There is a sharp focus instead on profitability (or a rapid path to it), on positive free cash flow and an emphasis on DCF and comparative based multiples.

Read the previous editions:

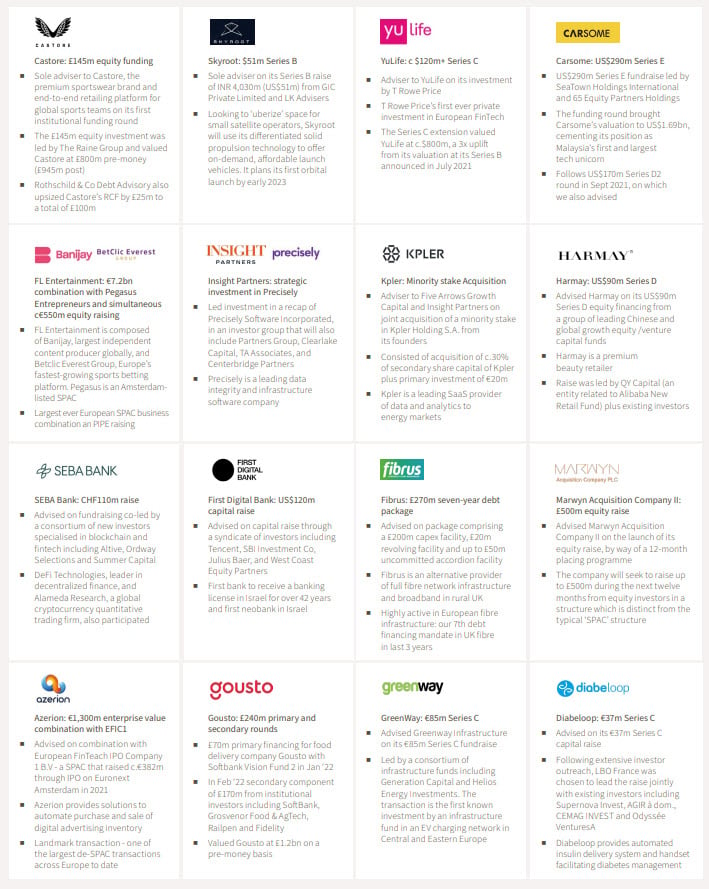

Rothschild & Co: Selected recent deals in Growth Equity and Private Capital

A selection of recent deals on which we have advised

For more information, or advice, contact our Growth Equity team:

Chris Hawley

Global Head of Private Capital

chris.hawley@rothschildandco.com

+44 20 7280 5826

+44 7753 426 961

Patrick Wellington

Vice Chairman of Equity Advisory

patrick.wellington@rothschildandco.com

+44 20 7280 5088

+44 7542 477 291

Mark Connelly

Head of North American Equity Market Solutions

mark.connelly@rothschildandco.com

+1 212 403 5500

+1 917 297 5131

Stéphanie Arnaud

Managing Director – France

stephanie.arnaud@rothschildandco.com

+33 1 40 74 72 93

+33 6 45 01 72 96

This document does not constitute an offer, inducement or invitation for the sale or purchase of securities, investments or any of the business or assets described in it.

This document has been prepared from publicly available information. This information, which does not purport to be comprehensive, has not been independently verified by us or any other party. The document does not constitute an audit or a due diligence review and should not be construed as such. The information provided should not be relied on for any purpose and should not in any way serve as a substitute for other enquiries and procedures that would (or should) otherwise be undertaken.

No representation or warranty, expressed or implied, is or will be made and, save in the case of fraud, no responsibility or liability is or will be accepted by us, as to or in relation to the accuracy, sufficiency or completeness of this document or the information forming the basis of the document or for any reliance placed on the document by any person whatsoever. No representation or warranty, expressed or implied, is or will be made as to the achievement or reasonableness of, and no reliance should be placed on, any projection, targets, estimates or forecasts and nothing in this document should be relied on as a promise or representation as to the future.

Law or other regulation may restrict the distribution of this document in certain jurisdictions. Accordingly, recipients of this document should inform themselves about and observe all applicable legal and regulatory requirements. This document does not constitute an offer inducement, or invitation to sell or purchase securities or other investments in any jurisdiction. Accordingly, this document does not constitute a Financial Promotion under the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 or equivalent legislation in other jurisdictions. This document is being distributed on the basis that each person in the United Kingdom to whom it is issued is reasonably believed to be such a person as is described in Article 19 (Investment professionals) or Article 49 (High net worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 or is a person to whom this document may otherwise lawfully be distributed. In other jurisdictions, this document is being distributed on the basis that each person to whom it is issued is reasonably believed to be a Professional Investor as defined under the local regulatory framework. Persons who do not fall within such descriptions may not act upon the information contained in this document.