Growth Equity Update

September 2024 – Edition 30

- A deep dive on Insurtech: A tough environment. Globally VC funding for Insurtech peaked at $16.6bn 2021, halved to $8.8bn in 2022 and fell another third to $5.9bn in 2023. In Q1 2024 just $0.8bn was raised for Insurtech. We look at the model of Insurtech and how its VC backed companies are facing the growth challenges.

- 2022’s long shadow: A survey by Carta appears to indicate the volume of VC backed companies going out of business increased sharply in late 2023 and early 2024 – a delayed consequence of the inflation/ interest rises post the 2022 Ukraine invasion.

- Klarna revival continues: Revenue up 27% in H1 2024, operating costs flat, adjusted operating profit of SEK 673m, up SEK 1.1bn vs the H123 loss of SEK 456m.

- August -VC raises strong in US, lull in Europe: Our US Deal Monitor recorded 24 $100m+ US VC deals in August raising $6bn, marginally ahead of July’s $5.9bn. Europe’s total of $0.8bn was low but July/August combined was 9% up on 2023 and ytd European raises are up 29%.

- Recession fears and interest rate cuts: Even as the pace of interest rate cuts picks up, markets are stalked by recession fears. Eyes on the next Fed meeting on September 17-18 where a cut of ‘just’ 25bps may be greeted with disappointment.

- ‘If things were simple, word would have gotten around’ – Jacques Derrida.

Click here to download a PDF version of Growth Equity Update

Insurtech - taking cover

‘Insurance is such a difficult industry and it’s so slow moving. It’s so slow to really make a difference at scale. When you look at insurance companies, 99% of the business they already have — 1% is what they basically have to fight for. There’s no urgency to change. And that’s why it’s not easy to build a new disruptive player in insurance.’ wefox founder Julian Teicke

In this latest of our series of industry deep dives we look at Insurtech. A branch of the broader fintech environment, Insurtech was greatly favoured by VCs at the start of this decade. The funding difficulties of the VC industry, regulatory hurdles and the response of the insurance incumbents has meant though that the industry has developed more slowly than originally expected while levels of VC funding have been more tepid.

As with the broader fintech industry, Insurtech is based on the concept that advances in technology and data can improve the level of services given to customers with providers freed from the constraints of legacy systems and working practices. Through innovative use of new datasets and data linking, insurtechs believe that they can assess risk more accurately, price risk better and devise new products and revenue streams not available to their traditional counterparts. A common example is the use of Internet-of-Things (IOT) telemetry systems embedded in cars to monitor driving style. Such systems can be used to reduce premiums for ‘safe’ drivers. More dramatically, it opens the opportunity for young, newly qualified drivers, a group that finds insurance hard to come by or prohibitively expensive, to buy affordable insurance based on safe driving technique and sometimes limited hours of car use (for instance, not after 8pm) to avoid periods when young drivers are at greatest risk of being in accidents.

The approach is thus one that assesses customers not by age, postcode and other generalised risk parameters but by data driven criteria allowing insurtechs to create highly personalised custom policies with dynamic, personalised pricing.

Insurtechs work to popularise insurance and adapt its use with customers by making it more approachable, affordable and convenient. Thus, the use of apps to manage insurance, gathering disparate insurance coverage onto one platform, insurance for groups and for one -off events, and apps to drive engagement with insurance.

An example of the latter is that of YuLife, which offers corporates life assurance coverage for employees. YuLife’s approach is to engage employees with their insurance through an app using gamification, with employees able through adopting healthy living habits to earn YuCoin to obtain rewards (charity donations, plant a tree etc). The focus thus shifts from paying out on illness to promoting health and wellness. Upfront premiums are higher than for traditional insurers, the offset being greater employee satisfaction, higher retention rates and lower absenteeism. YuLife raised $120m at a valuation of $800m in a funding round led by Japanese insurer Dai-ichi Life in July 2022.

Insurtechs also work on the underlying processes of the insurance industry to make them more efficient. These companies are employing new technologies to speed up and lower the cost of functions such as claims processing, risk assessment and contract production.

An interesting example is Tractable, a US/UK company using artificial intelligence techniques to speed up the process of autos claims. Tractable uses AI and computer vision techniques to assess damage to vehicles remotely. Using the Tractable app anyone with a smartphone can quickly and accurately assess a vehicle’s external condition and possible damage simply by walking once around the car. The app accesses Tractable’s AI platform which has been trained on hundreds of millions of images to understand auto damage like a human assessor. AI inspection is available in North America and Japan. Tractable processes c$7bn of claims annually working for customers like Aviva, Geico, Admiral and Ageas. In 2021 it raised $60m at a $1bn valuation in a Series D led by Insight Partners and in July 2023 $65m in a Series E led by Softbank at a lower valuation. Other VC backed companies, like FlyGuys and DroneHub, supply drones to make insurance assessments in hard-to-reach areas.

By their nature insurtechs are well suited to opening up new insurance market categories. These companies have a more even playing field relative to the major incumbent insurance businesses in these new categories.

EnvelopRisk is a data driven reinsurance business specialising in the new market of cyber risk The company's service offers model cyber risk which applies an augmented intelligence approach, combining human expertise in cybersecurity and underwriting with artificial intelligence-enabled modelling and simulation, giving insurers and reinsurers insight into likely attacker targets and existing defences. Envelop Risk’s proprietary machine-learning model assesses over a million companies, their defences, current attacker activity, and historical attack trends. For each company it assesses the nature and financial value of its assets and the extent of its vulnerability to different types of attacks and compares that data against emerging and historical attack trends to predict expected losses – establishing a rigorous basis for recommended insurance and reinsurance pricing. Envelop Risk’s principal source of cyber reinsurance capacity is MS Amlin, which also has a stake in the company. Cyber risk is growing fast, driven by new technologies like GenAI, cloud and IoT as well as the sophistication of cyber criminals and heightened geopolitical risk.

The global cyber insurance market has almost tripled in value over the past five years reaching a size of US$14bn in 2023 and estimated by Munich Re to increase at c18% pa to US$ 29bn by 2027. One of the key approaches of EnvelopRisk is to separate cyber insurance from general risk insurance. In doing so EnvelopRisk is ensuring companies have specific insurance for cyber risk instead of hoping to capture it as part of a broader policy, a factor contributing to the rapid growth in the category.

Zego is a London based insurtech which specialises in insurance for self-employed drivers, particularly delivery drivers, using scooters and motorbikes as well as drivers for Uber, Bolt and Rides businesses. The policies offer flexible cover meaning that the customer does not have to be tied into long contract periods. Indeed, scooter drivers are charged by the minute with a minimum of one hour’s cover, meaning that they can pause the cover when they are not working. Drivers who use the Zego Sense app, which uses the driver’s smartphone to monitor driving performance, get discounted rates. Zego raised $150m in March 2021 at a $1.1bn valuation led by DST Global. In its last full year accounts filed with Companies House Zego had gross turnover of £20.9m, net turnover of £13.2m and a pretax loss of £72m.

The process of creating new markets in insurance and new methods of reaching customers of course comes with risks, particularly in an insurance market that since 2022 has faced the challenges of high inflation impacting customer demand and inflating claims costs. We look at a couple of examples of how insurtechs have faced the challenge of a changing external environment and the need to curb expansion in favour of greater profitability and durability.

ManyPets was founded in 2012 by Steve Mendel and Guy Farley. The business, originally known as Bought by Many, initially focused on helping consumers find better deals on a range of niche insurance requirements. One of these niches, Exotic Direct, was insurance for exotic pets launched in 2015. Its potential led the company to focus its proposition on the provision of pet insurance in 2017, underwritten by Great Lakes Insurance, part of Munich Re. ManyPets launched a range of dog and cat insurance policies with the aim of providing a fair, transparent and digital first service for this substantial ( 34m pets in the UK alone) but under-served market. It offers a subscription-based model with access to both pet health insurance and pet wellness packages.

As the graphic shows the number of insured pets rose from 42,000 at the end of 2017 to 87,000 a year later at which point the company launched in Sweden. It quickly became one of the leading pet insurers in Europe and entered the US market in 2021 by which time it was providing insurance for almost 0.5m pets. Gross written premium rose from £20m in 2018 to £35m in 2019, £72m in 2020 and leapt to £146m in the year to March 2021. ManyPets was arguably a Covid beneficiary with lockdown meaning that 3.2m UK households took on a new pet. Penetration potential is also substantial. Although 25% of UK pet owners have insurance, only 2% of US pet owners do so.

The progress of ManyPets

Having previously raised £27.5m in two early funding rounds, led by Octopus and CommerzVentures respectively, ManyPets raised £78.5m in a Series C in 2020 led by FTV Capital. This was swiftly followed in June 2021 by a $270m ($350m) Series D led by EQT Growth at a valuation of over $2bn. Amongst other things the proceeds were to be used to expand the reach of the business throughout the US.

In October 2022 ManyPets Inc bought Digital Edge Insurance Company from MunichRe, giving it capability to act as a carrier, writing its own policies in the US although it also continued to work with its existing provider Accredited Surety and Casualty Company. In January 2023 ManyPets switched the underwriting of all its UK policies to Wakam, a French business describing itself as the European leader in digital and embedded insurance.

Company House reports for the parent company Many Group show revenue rising by 2.7x from £17.4m in 2020 to £46.7m in the year to March 2022. Administrative costs kept pace rising by 2.8x from £30.6m to £84.2m meaning that the group operating loss rose by 2.5x to £38.9m. The year to March 2023 saw a shift in the business environment with the impact of the Ukraine war (which started in February 2022) feeding into inflation and rising interest rates. Revenues fell 10% to £42.2m while costs grew by 24% to £104m meaning the operating loss rose by 1.7x to £65.5m.

The company noted in its 2023 Report & Accounts that growth in GWP slowed to 14% in the year to March 2023 as the business responded to ‘many external challenges’, notably rising inflation causing an increase in the loss ratio. It reoriented its approach to its key priorities of a ‘healthy loss ratio, operational efficiencies and economically attractive growth.’

ManyPets stressed ‘the need to prioritise sustainable profitability over rapid growth’ and undertook a series of actions in response. These included:

In May 2023 ManyPets paused marketing in the US, reportedly to deal with customer acquisition costs that were ‘too high’ combined with ‘lower than planned’ average order value and retention leading to an LTV/CAC ‘much lower than it needs to be.’

A key element was a programme to optimise its pricing models and manage health provider costs. Some redundancies were carried out. In May 2023 ManyPets announced that it would no longer offer pet insurance in Sweden and the business sold its exotic pets arm to focus entirely on the dog and cat offering.

In October 2023 Luisa Barile, CFO of ManyPets (now group CEO) commented:

"Like most insurance businesses, we were hit by high inflation in 2022-23. Vet treatment in particular rose higher than CPI and negatively affected our revenues. Despite this, we maintained significant market share among more established competitors, achieving group sales of £630m over the last three financial years, with GWP growth of 14% in the last FY alone. As the global economic growth faltered, we took a number of corrective actions in 2023 to improve our position. This included focusing our investment on our core markets in the UK and US, as evidenced by our decision to exit from the Swedish market. We also continue to invest in evolving our business operations to meet our customer growth. This will ensure that our service levels match the high standards our customers have previously experienced. Specifically, we have invested in machine-learning powered claims technology, and claims processed directly by vets using our new portal are completed in industry-leading processing times."

Despite rising premiums ManyPets customers appear to retain faith in the company which scores a highly creditable Trustpilot score of 4 out of 5.

A second example of an insurtech adapting in the face of external challenges is that of wefox.

wefox was founded in Berlin in 2015 and emerged as a leading digital personal insurance player active in household motor and personal liability. Its business model uses traditional means of selling insurance, predominantly using (human) third party agents combined with some direct distribution. It combines this with digital analytics intended to produce better than market loss ratios and digital ‘straight-through-processing’ which uses technology to reduce administration costs with 80% of processes being handled automatically.

For the consumer the insurance, once sold, is visible and can be updated via an app. wefox sold purely third-party insurance products until 2023 working with around 300 insurance companies in property, casualty, life and health. In 2023 it supplemented this with its own insurance carrier wefox Insurance, although 90% of its €2bn of premiums in 2023 continued to come from the distribution business.

wefox championed its use of agents for rapid market penetration:

“Unlike most direct-to-consumer insurtechs, wefox acts as an ecosystem enabler - empowering the various distribution channels instead of competing with them. This model has allowed wefox to scale quickly and sustainably, providing brokers and customers alike a platform that seamlessly digitizes the insurance market.”

In July 2022 wefox had a network of 3,000 independent brokers in Germany. A year later it was up to 4,000 distribution partners and was operating in six European markets - Germany, Switzerland, Austria, Italy, Poland and the Netherlands.

wefox initially operated in Germany and expanded into Austria in 2017. In August 2018 it entered Italy, partnering with Milan brokerage, Mansutti by providing software and an updated CRM system. Tomaso Mansutti, CEO observed:

"Our customers can use the wefox app to view and optimize their insurance policies anytime and anywhere, agree new contracts and report claims - all digitally in one place. We expect excellent customer satisfaction and loyalty."

In March 2019 wefox had its first significant fundraise, a $125m Series B led by Mubadala at a $1.25bn valuation. Wefox designated the proceeds to expand into the European broker market and to develop ‘advanced data analytics. Founder and CEO Julian Teicke commented:

“Our hypothesis is that insurance will be massively impacted by the IoT data revolution. Insurers will have access to an exponentially grown number of real-time variables in order to price insurance products in real time. This trend will change insurance from a pure financial service to a service that offers proactive advice to reduce risk and consists of a financial service component only as an add-on to the core business model.”

The Series B was extended in October 2019 with a further $110m led by Omers Ventures. At that stage wefox reported ARR of over $100m and 0.5m customers. wefox entered Switzerland in 2020 and Poland in April 2021.

Buoyed by its rapid progress in May 2021 wefox announced a $650m Series C led by Target Global at a valuation of $3bn. Julian Teicke commented wefox was:

"Tackling that $5.2 trillion industry that has been stuck in the pre-internet era. We nailed how to disrupt it in our core market."

2020 revenue was $143m, doubling that of 2019.The company established an AI team in Paris and announced its intention to launch in Italy with its own company which it did in February 2022.

In July 2022 a Series D round of $400m followed, led by Mubadala and LGT and valuing the company at $4.5bn, meaning it had raised $1.05bn in just 14 months.

wefox reported that revenues in the first four months of 2022 were $200m -an ARR of $600m- versus the $320m of 2021 total revenues and it reported two million customers. wefox highlighted that its indirect distribution through brokers and agents was enabling it to enter new markets quickly and to reduce the customer acquisition cost. It planned to use the funding to expand across Europe and into Asia and the US. The number of wefox employees in July 2022 was 1300, up from 550 in 2021 and the company stated that it expected to have 2000 employees by the end of 2022.

This rate of expansion appears to have overstretched the company. In early 2023, now operating in six countries, it shifted its focus towards moving to profitability in its existing activities. It combined this with a further raise of $110m in May 2023, split equally between equity and debt. The new funds were targeted towards the launch of wefox’s Global Affinity business connecting insurance companies with partners to distribute insurance products, to the technology platform and to wefox’s three AI hubs.

At the same time wefox announced a renewed focus on profitability, targeting break even by the end of 2023. To this end it announced it would deprioritise its first-party insurance business in favour of its distribution business. Julian Teicke commented:

“Insurance is such a difficult industry and it’s so slow moving. It’s so slow to really make a difference at scale. When you look at insurance companies, 99% of the business they already have — 1% is what they basically have to fight for. There’s no urgency to change. And that’s why it’s not easy to build a new disruptive player in insurance. And I felt that we have to understand how distribution works, how insurance works. Every insurer will need to become digital. There will be a digital infrastructure company for insurance companies.”

In October 2023 wefox announced a new CFO, Jonathan Wismer, ex Resolution Life U.S. and AIG replacing co-founder Fabian Wesemann who shifted to head up the company’s M&A unit. This was followed by a further raise of $55m in convertible debt financing from Deutsche Bank and UniCredit.

In March 2024, Wefox announced that its CEO and founder Julian Teicke would become non-executive President with Mark Hartigan, previously CEO at LV= being appointed Executive Chairman and CEO.

Bloomberg press reports suggest that in 2023, wefox had revenues of €739m and an adjusted EBITDA loss of €72m. In the first four months of 2024, revenues were up 33% yoy to €446m, while the adjusted earnings loss improved to €17m.

Nevertheless, the company moved quickly to improve profitability. In its 2023 Solvency and Financial Condition report wefox management observed that it saw:

"2023 as a pivotal year for the company and the strategy has changed from ambitious growth towards profitability and sustainability. Detailed action plans per country and line of business to reduce loss ratios are in place …. For markets and products where we expected the required profitability thresholds not to be achieved within reasonable time, the decision was made to stop new business, leaving the company primarily offering products for STA in Switzerland, E-Bike insurance Germany and Motor business in Poland, which still represent sizable addressable markets."

In May 2024 Sky News reported that the new CEO had stated wefox required at least €70m to remain solvent through the end of 2024, observing that the Italian business 'is now insolvent without group cash support' and that liabilities in Germany were 'very significant and could introduce a large cash strain on the company.'

The new management announced plans to close the company’s operations in Germany, to sell part of its Polish operations, unwind a joint venture in Switzerland and to stem loses in Italy.

In mid-June 2024 press reports suggested that Mubadala, one of wefox’s lead investors, was considering a sale of the business to the Ardonagh Group, a major independent broker, for $374m upfront and a potential deferred payment of $213m, a total of $586m.

Instead, the company’s AGM backed an alternate proposal which saw a further €25m cash injection from Chrysalis Investments and Target Global and the intention to make disposals, including of its e-bike insurer assona for €50m.

The new wefox statement announced considerable progress in reshaping the group.

"The ongoing restructuring initiatives and asset sales have been making rapid headway with the bulk of the execution expected to be completed by year-end. Going forward, Wefox will only focus on markets where it has profitable operations of critical size or is on track to achieving this within the next 12 months. In this context, the company will further build out its leading market positions in the Netherlands, Austria and Switzerland, and will withdraw from the German market. Italy remains a core position in wefox’s business portfolio and will undergo a transformation to improve its profitability. Additionally, technology development efforts will centre on empowering local distribution platforms. Consequently, wefox is closing down its technology hubs in Spain and France.

The new focus also means that the insurance carrier, Wefox Insurance AG, will no longer be part of the company's core business. In addition, Wefox Insurance AG is actively seeking the disposal of selected portfolios that are not in line with its future risk appetite, starting with the sale of the Polish portfolio."

The sale of assona to the Ecclesia Group followed. The insurance brokerage activities in Germany were sold to IWV AG and in August 2024 Vector8 acquired wefox’s 15 strong AI team in Paris.

wefox timeline 2016-24 - $4.5bn raised

Indeed the $900m raised by Canadian legal tech business Clio in July was the largest ever such raise in this field. Clio’s $900m Series F, a mixture of primary and secondary, valued the company at $3bn which, with ARR at c$200m (up 100% in two years) gave an implied ‘sales’ multiple of c15x. Of the funding $500m came from New Enterprise Associates with GSAM and Sixth Street Growth also prominent.

Also in July US business Harvey AI raised a $100m Series C valuing the company at $1.5bn with an ARR multiple of c60x. The impressive roster of investors included Google Ventures, OpenAI , Kleiner Perkins and Sequoia. As the Exhibit indicates these two recent rounds have led a series of smaller deals for emerging legal tech businesses.

These emerging companies address three main areas:

AI for practice management: These are ‘business of law’ applications often using GenAI to simplify practice management, document handling and key functions like billing. Examples include Clio for large law firms and LawHive for small solicitor practices with its GenAI assistant, Lawrence.

AI techniques to simplify and speed up case preparation: These applications assist lawyers in case preparation. An extension of the Google search style techniques they allow lawyers to use natural language to interrogate databases with the AI functionality capable of producing accurate and relevant results from substantial records almost instantaneously. These can be sold both as an efficiency tool and as a route to provide better, deeper insights, potentially driving new business.

Examples include Harvey AI’s Gen AI powered ‘co-pilot’ for lawyers. Swedish business Leya’s ‘AI powered workspace designed for law firms and legal professionals’ automates repetitive tasks and accesses public sources and lawyers’ own data on a single platform. Hebbia which describes itself as ‘the AI platform for knowledge work’ has developed an AI driven system called Matrix to search large documents. Others in this field are Draftwise, LegalFly, LegalMation, DeepJudge, Definely and Paxton.

Legal AI for contract production: Producing new contracts and responses to tenders is laborious and time consuming. A number of companies have focused their AI applications to speed these processes up and to democratise them by developing protocols to allow non-legal divisions of a corporate, such as sales, to use AI based products to issue accurate and binding legal documents (trained on the templates of the company’s legal department) without the necessity for lengthy review and correction processes. Among companies offering this rapid contract drafting capability are Luminance, RobinAI, AutogenAI, Spellbook and Superlegal.

The recent $900m Series F raise for Clio valuing the company at $3bn was the largest capital raise and equity value ever for a cloud legal software business and a top five capital raise for any vertical market software company.

At its heart Clio is a legal practice management software business. Its focus is on helping legal firms to run more efficiently – the business of law- an area embraced by incumbent legal information providers in recent years.

Clio’s ‘operating system for law firms’ manages core law firm functions such as client intake and case and document management. It claims also to be the world's largest legal technology platform, with more than 250+ legal technology software integrations. Its focus as a business was originally with solo practice and small law firms but it has moved strongly into the mid-market. Clio is endorsed by more than 100 law societies and bar associations worldwide, including all 50 state bar associations in the United States. Founder Jack Newton observes:

“We’ve quietly become the market leader in cloud-based law practice management for midsized law firms, with over 1,000 customers in that market.”

Much of the recent growth has been driven by its payments business. Payments management in legal businesses is complex and time consuming for small law firms. The addition of an online payment processing platform to simplify this quotidian but critical process was a natural extension of Clio’s Manage platform. The Clio system processes billions of dollars of legal transactions payments each year taking a modest percentage of the value of each transaction.

Clio’s core business is not dependent on GenAI techniques. The Series F announcement came with a raft of forthcoming GenAI based product developments Clio hopes shortly to release. These include:

- The Clio Duo proprietary GenAI solution to help lawyers complete routine tasks, and leverage their firm analytics to run a more efficient practice; including audit log functionality for court discovery

- Clio Accounting to manage firm finances in one system of record

- Clio Draft intelligent document automation and court form libraries in 50+ jurisdictions

July also saw US LegalTech Harvey AI raise a $100m Series C valuing the company at $1.5bn with an ARR multiple of c60x. The impressive roster of investors included Google Ventures and OpenAI as well as Kleiner Perkins and Sequoia.

Harvey’s focus is on a GenAI powered ‘co-pilot’ for lawyers designed to assist with research, drafting and other routine legal tasks. The ‘co-pilot’ is trained to answer natural language questions. Harvey AI uses OpenAI’s GPT AI which is trained specifically on legal data such as case law and reference materials and, when engaged by a firm, on that firm’s own work products and templates.

A lawyer asks Harvey to find relevant documents, to produce early drafts of filings and queries it on points of law. The answers are derived from the original source material with citations to the most relevant sections.

In transactional work, Harvey is most frequently used in drafting, due diligence and deal management as well as research and strategy. In litigation it can also provide strategic analysis of regulation and legislation and how they apply to particular fact patterns. Other substantial use cases include case law research, review of discovery and litigation documents and advocacy strategy for both trials and oral arguments. The top use cases of Harvey amongst its customers are shown here.

In late 2022 Allen & Overy was the first law firm to partner with Harvey which has since been used by 3,500 of its lawyers. In March 2023 PwC, which has 4000 legal staff, partnered with Harvey across its 100+ countries to deliver ‘human led and technology enabled’ solutions in ‘contract analysis, regulatory compliance, claims management, due diligence and broader legal advisory and legal consulting services.’ PwC is training its proprietary AI models with Harvey to create customised products and services for clients.

In June 2024 Ashurst rolled out Harvey across all its offices after a global trial involving 525 users. David Wakeling, head of Allen & Overy Shearman’s Markets Innovation Group commented:

“…I have never seen anything like Harvey … Harvey can work in multiple languages and across diverse practice areas, delivering unprecedented efficiency and intelligence. In our trial, we saw some amazing results.”

Harvey’s management team says of the Series C proceeds: ‘We will use this new capital to invest in the engineering, data and domain expertise that are fundamental to building AI-native systems that facilitate the most complex knowledge work.’

Another company looking to speed up repetitive and manual tasks performed by lawyers is the Swedish business Leya. Citing strong investor demand it followed up a $10.5m seed round in May 2024 with a $25m Series A round in July led by Redpoint Ventures.

Leya describes itself as ‘an AI powered workspace designed for law firms and legal professionals’ which allows customers to automate repetitive tasks and access public sources and their own data on a single platform. Its legal assistant uses public legal sources, the firm’s proprietary data and can access a customer’s files and documents from its document management system (DMS). It combines them with legal information from fifteen jurisdictions to provide ‘sentence-level citations and references to the underlying material in its output’ enabling due-diligence reviews and document editing.

Leya has been adopted by more than 70 law firms internationally. It reports that It frequently finds itself in competition with Harvey and also with incumbent WestLaw’s CoCounsel product.

Hebbia’s June 2024 Series B raise of $130m was led by a16z Index Ventures and Google Ventures. The round valued the company at c$700m, an implied c54x ARR of c$13m . ARR is growing rapidly, up fifteen fold in the last 18 months.

Hebbia which describes itself as ‘the AI platform for knowledge work’ has developed an AI driven system, Matrix, to search large documents. Its initial target customer base was asset managers, banks and Fortune 100 companies. The company is now focusing on the top law firms in the AmLaw 100.

Hebbia has developed from an initial focus on AI powered search and summaries to the Matrix AI analyst tool. This is able to digest structured and unstructured data across multiple files and formats, to retrieve information when prompted, and deliver answers with citations. The end result is delivered in a spreadsheet-like format. Matrix shows the sourcing and individual steps it took to reach its conclusions.

Alex Immerman of leading shareholder a16z comments:

“We are entering the new SaaS era, moving from Software-as-a-Service to Service-as-a-Software. Until now, software has helped knowledge workers do their jobs better: Bloomberg or Capital IQ for finance, Westlaw or Lexis Nexis for legal, Salesforce or HubSpot for sales. But in the not too distant future, an AI agent is going to do their jobs entirely for them. Whether an agent is reviewing more deals, automating quarterly earnings reviews, or leveraging cross-firm knowledge to drive to faster client value, AI coworkers will soon be an integral part of our day to day.”

Luminance describes itself as the leader in ‘legal-grade’ AI. It announced a $40m Series B raise in April 2024. Its specialist legal Large Language Model (LLM) automates the generation, negotiation and analysis of contracts and other legal documents. The LLM is trained on a dataset of 150m legal documents enabling it to understand areas of legal risk and learn from previous contracts. Luminance AI speeds up the contract lifecycle process, including drafting, negotiating and understanding key features of contracts. The company has a customer base of 600 in 70 countries.

Luminance CEO Eleanor Lightbody comments:

“Luminance is AI for wherever businesses interact with their contracts. It's AI to help them review and negotiate contracts faster, automating that process. It will tell you the nuances of all of your contracts. It will tell you which parts of the contract you can agree to, and the ones you can’t. Plus, for anyone who wants to create a contract, it will allow them to do that in seconds.

The fact is legal teams are resource limited. …Contracts are very manual, very time consuming, very expensive, and can introduce a lot of risk. So, we were the first company to begin to automate that process from end to end.”

In late 2023 during a live demonstration in front of media outlets, Luminance became the first AI system to automate the negotiation of a contract between two parties, without human intervention. Luminance was the first AI system used by counsel at London’s Old Bailey criminal court where it was used to cut the time spent reviewing evidence.

Luminance is looking to extend its use beyond legal departments. Non-legal parts of a corporate are able to use its ‘Self Serve’ to draft their own contracts from templates approved by the in house legal team. Thus a sales team can use a template to draft a contract for a prospective customer rather than sending it off for potentially laborious review and revision by their legal team. They can also amend third party contracts in line with internal standards speeding up the commercial process.

RobinAI, which raised $26m in a round led by Temasek in January 2024, has developed a similar AI-powered contract software. It claims this enables users to review contracts 80% more quickly taking, for instance, just a few seconds to search for a clause. Robin AI’s contract copilot combines an LLM ( it partnered early with Anthropic and uses the Claude LLM) with its proprietary contract data and machine learning techniques to read and understand contracts. Customers add their own negotiating templates and the Robin copilot will quickly review a contract, and propose edits, which can easily be accepted or rejected. The customer lawyers retain full control over the process.

RobinAI charges an annual licence fee for access to its software platform plus ad hoc charges on a per contract basis. 75% of its revenues are in the US. Customers include Clifford Chance, Pepsico, PwC, Yum! Brands, AlbaCore Capital Group and Blue Earth Capital.

AutoGenAI has a similar capability with its AI bid writing engine which helps businesses respond to bids and tenders for public sector and corporate contracts. The company raised a $40m Series B led by Salesforce Ventures and Spark Capital in December 2023.

AutogenAI estimates that, using its system, a bidder can reduce the time taken to write a first draft for a procurement deal by 70%, reducing costs and allowing the bidder to focus on strategic aspects of its bids. Frequently its customers are resource constrained SMEs looking to bid on complex public tenders. AutoGenAI uses LLMs and its own platform and integrates an organization’s content, such as previous bids and marketing materials, to produce proposals specific to the tender.

‘Justice intelligence platform’ Darrow is a lead generation business for class action litigation lawyers. Darrow’s AI data engine ingests publicly available documents such as consumer complaints, administrative documents and SEC filings to find examples of class action litigation potential, typically in areas like data privacy violations and environmental contamination. The system connects relevant data points to detect potential legal violations that its lawyer customers might be able to turn into class action lawsuits,

Having found the cases Darrow then helps to find the potential plaintiffs using its PlaintiffLink product to identify, connect with, and manage the plaintiffs, acting as a business lead generator for litigation teams. Its AI driven service is also able to predict the outcome of cases and assess the financial implications – cost to pursue versus likely outcome. So far it has partnered with over 50 law firms in the US.

There has been a welter of smaller raises in recent months in LegalTech. A number of these are outlined in the Exhibit. Many of these touch upon the practice areas of their larger counterparts. What is notable is the quality of some of the names investing in these relatively small businesses. Index Ventures led the March 2024 $20m raise for Draftwise. The business is an AI led drafting and negotiation platform for transactional lawyers. Thomson Reuters Ventures, whose parent owns industry leader Westlaw, participated in the $20m January 2024 round for Canadian contract drafting and review business Spellbook.

Google Ventures (GV), OpenAI and Kleiner Perkins were all on a $12m seed ticket for the consumer law firm platform Lawhive which can perform the ‘basic legal work at the level of a junior or paralegal’ in April 2024. The Scottish start up Wordsmith’s $5m seed round in June 2024 attracted both GV and General Catalyst. Its product is aimed at corporates with its ‘lawyer in the loop’ concept giving customers ‘90 per cent of the through-put of a world-class lawyer and a 99 per cent cost reduction versus going to a law firm.’

The $5m raise in May 2024 by SuperLegal for its AI contract review service for corporates was supported by Aleph and the Disruptive AI fund and also by Tom Glocer, the first CEO of the combined Thomson Reuters.

Post the development of the large LLMs the market has been looking for the key verticals in which GenAI techniques will be employed. It seems that LegalTech is being marked out as such a key vertical. Of course the new aspect of AI is the ability of large language models (LLMs) to use prompts, whether via text or image, to generate new content- the obvious examples are in music, writing and AI generated images.

Search, one of the key aspects of many of these LegalTech companies’ capabilities is, by contrast, not a new capability although LLMs are capable of aggregating Internet content and presenting the results of search differently to Google style website linking. The companies we have highlighted in some cases marry existing data gathering capabilities ( predictive coding , machine learning) with newer GenAI based capabilities. Most would argue that a key part of their business is simply understanding the customer processes and pain points and using that insight to develop useful solutions that solve problems – with GenAI contributing along the way. It is this understanding of the customer allied with technical innovation and deep domain knowledge that has kept the likes of RELX, Thomson Reuters and Wolters Kluwer at the top of the tree for so long.

Public markets – All change

Fed on peanuts…..

Public markets performed well in H1 2024. To the 28th June the MSCI Global index was up 11.3%. The US led the way, up 14.6% with the Magnificent Seven stocks up 36%, NASDAQ up 20% and the S&P 500 up 15%. In Europe the STOXX 600 was up 7% and the FTSE 100 up 6%.

July fared less well with a tech shake out hitting the Magnificent 7, contributing to a fall in the leading indices. There was in turn a natural rotation into value and small companies which outperformed. In the month of July up to August 2nd ( to take into account the timing of the interest rate decisions in the US and UK, albeit not the market shakedown subsequently) the Magnificent 7 led the way down falling by 9% in the month, NASDAQ fell by 7%, and the S&P500 and STOXX 600 by 3% . The FTSE 100 rose by 1% and the Russell 2000 Index of smaller US companies by 4%. The MSCI World Index was down 2.5%.

The end of the month was dominated by interest rate moves (or the lack of them), growing fears of US recession and a results season which indicated aroused fears of consumer slowdown in the US and elsewhere.

At the Fed’s meeting on July 31 rates were held for the eighth month in a row. This was in line with expectations although it disappointed some who thought that signs of a slowing US economy meant that a surprise July rate cut could be in order. Fed chairman Jay Powell retained his typical measured approach indicating that further progress had been made in reducing inflation towards the 2% target while indicating that the Fed would need ‘greater confidence’ before it would actually cut rates. At the same time the Fed gave a clear indication that the greater confidence might be in place by September’s meeting with Powell saying:

“A reduction in our policy rate could be on the table as soon as the next meeting in September.”

Such a reduction seemed even more likely by the end of the same week. The Fed’s meeting was on Wednesday 31st July. By Friday August 2nd the markets had begun to recoil as mediocre jobs data fuelled fears of recession.

The continuous effort by the Fed is to discourage inflation while maintaining economic growth and avoiding recession. There was acknowledgment in the Fed meeting that its thoughts were turning as much to the economy as to inflation, Chairman Jay Powell noting:

"if we see something that looks like a more significant downturn, that would be something that … we would have the intention of responding to…If the labor market were to weaken unexpectedly or inflation were to fall more quickly than anticipated, we are prepared to respond."

Thus far through 2024 it appeared to be doing a reasonable job and the market had responded by pricing in a US soft landing – or even no landing at all –as opposed to recession. Thus the July Bank of America fund manager survey indicated 68% of participants expecting a US soft landing and just 11% a hard landing, down from 17% at the start of the year.

Sahm Rules? The Fed’s decision not to cut interest rates in July was followed by weak US jobs data announced two days later with the 114,000 jobs added in July below market expectations of 175,000. Unemployment rose to 4.3%. By itself this set of figures was mediocre rather than bad – employment is still rising and July is, in any case, not the most important month for jobs data. The rise of the unemployment rate to 4.3% though triggered a widely followed recession indicator, the Sahm Rule:

“When the three-month moving average of the national unemployment rate is 0.5 percentage point or more above its low over the prior twelve months, we are in the early months of recession.”

This indicator has been a reliable signal that the US is in the early stages of a recession. In the eleven recessions since 1948 the Sahm rule has only produced two false positives (in 1959 and 1969) and in both failures the indicator can be said to have been too early rather than outright wrong. Claudia Sahm, its inventor, observed in an interview post the July jobs figures that the indicator could be misleading this time – citing growing household incomes and resilient consumer spending and business investment. Sahm also noted that there was an unusually high figure of 420,000 new entrants to the labour market in July which contributed to the rising unemployment rate.

Nevertheless the combination of the weak jobs number, a results season in which the Magnificent Seven stocks mainly disappointed and the news that Berkshire Hathaway had halved its stake in Apple in Q2 sent shares falling at the start of August. On Monday 5th August Japan’s Nikkei fell 12.4%, the second largest daily fall on record and NASDAQ and the S&P 500 by 3% each.

In recent months market expectations have been for between two and three 25bps US rate cuts totalling 50-75 bps by 2024 year end. Post the July payroll numbers this increased to an expectation of a cut of 100bps by year end. The fed has indicated it is unlikely to make an emergency cut. Given there are just three Fed meetings until the year end it would imply a cut of 50bps at one of these meetings. All eyes are now on the Jackson Hole economic summit on August 22-24 for the Fed to give more clues as to its likely action at the September 17-18 Fed meeting.

European rate cuts underway. On June 6 the ECB lowered interest rates for the first time in five years, cutting the core interest rate by 25bps to 3.75% although the ECB indicated that it was ‘not pre-committing to a particular rate path’ with ECB president Christine Lagarde saying that further rate cuts will “depend on the data that we receive.’’ The market has pencilled in two more interest rate cuts by the end of the year which would take rates down to 3.25% and a further two rate cuts by the end of 2025.

UK interest rate cut: In the UK, May inflation was 2%, the first time since July 2021 it had hit the Bank of England’s target. The June figure was, albeit slightly higher than market expectations, also at 2% . On August 1 the Bank of England responded with a 25bps rate cut to 5%, the first rate cut since 2020. The decision was close, with a 5-4 majority on the BOE rate setting committee.

The BoE’s forecasts now show inflation getting back to 2.7% by year end before dropping back to 1.7% by 2026. It upgraded its 2024 UK GDP forecast from 0.5% to 1.25% with 1% expected in 2025. At present markets are anticipating between one and two more 25bps UK rate cuts by the end of the year.

Going against trend it is worth noting that Japan raised interest rates on July 31st. It moved its benchmark rate to 0.25% from the previous zero, the highest rate since 2008. In part the raise was to help offset rising inflation, up 2.6% in June, partly caused by the weakness of the yen.

Rothschild & Co strategist Kevin Gardiner summarises the current key drivers of the market in this graphic:

IPOs – Summer’s lease

July had the largest US IPO ytd with Lineage raising $4.4bn. In Europe 36 IPOs raised €11.4bn in H1 2024 versus 25 raising €2.5bn in H1 2023. The summer lull is now upon us. Assuming markets stabilise there is a strong pipeline in late 2024 and into 2025.

In July three $400m+ US IPOs raised a total of $5.5bn. This brought the number of $400m+ US IPOs to eighteen ytd raising, in total, $17.4bn. This compares with nine IPOs raising $400m+ during the whole of 2023 with an aggregate value of $14.1bn.

The July IPOs included the largest US IPO ytd. Lineage, which is the world's largest operator of cold-storage warehouses, raised $4.4bn and was the biggest IPO since the $4.87bn IPO of Arm in September 2023.

While the total amount raised by global IPOs in H1 2024 was down 18% yoy at $48.8bn ( LSEG data), the $17bn raised in the US was more than twice that of H1 2023 and the best for three years.

The overall performance of the 2024 US IPO cohort remains positive. 15 of the 18 saw a gain on the first day with the weighted day one advance being 12%. As of August 2, 15 of the 18 were still trading at above their flotation price with the weighted advance of the group being 21%.

18 US IPOs of $400m+ in H1 2024

In Europe 36 IPOs raised €11.4bn in H1 2024 versus 25 raising €2.5bn in H1 2023. Q2 was at €6.6bn after Q1’s €4.8bn. The top three European IPOs in H1 2024 were Spanish fashion operator Puig, Swiss healthcare business Galderma and the private equity house, CVC. Raising $2.5-2.9bn each, these were also the top three global IPOs in H1 2024.

The IPO window is open. There is a steady flow rather than a flood of IPOs and sponsors need to be cautious in terms of investor selectivity and pricing discipline. Nevertheless, the IPO market is building an attractive record that suggests it is worth the while of investors to participate. Meanwhile, there is little chance of a shortage of supply with, according to Pitchbook data, the backlog of venture-capital-backed firms waiting for an opportunity to go public standing at around 220 companies.

July - Another strong month for European VC backed raises

July’s raises saw a revival for biotech on both sides of the Atlantic.

July was a strong month for European venture capital raises with the R&Co Deal Monitor recording c$3.6bn of venture raises in the month making it the second highest of the year after January’s $4.3bn. The $3.6bn total in July was twice the level of the $1.77bn raised in July 2023 and 4% ahead of July 2022. With the 2022 comps easing we should see the 2024 totals now regularly exceed those of 2022.

YTD European raises are at c$21.4bn, up c44% yoy against 2023 in the same period. YTD to end July there have been 55 raises of more than $100m (vs 32 in the same period in 2023), plus 4 raises of $500m-$1bn (versus zero) and one of $1bn + ( versus zero). In total 60 $100m+ raises so far in 2024, almost twice the 32 of 2023 at this stage.

By category software deals led the way in July with three raises amassing $719m. French HR software business HR Path raised $550m in a deal led by Ardian. QX Global which offers business process management services raised $125m from Long Ride Equity Partners. German business osapiens raised $120m from Goldman Sachs Alternatives and Armira. The company offers SaaS solutions helping companies fulfil their ESG requirements.

There was a flurry of raises for biotech companies with 7 deals raising $712m including four deals raising $100m, those for Beacon Therapeutics ( $170m), CatalYm ($150m) , Myricx Bio ( $114m) and Ascenreuron ($100m). A similar resurgence of interest in VC backed biotech companies was seen in the US where two of the top five deals by value in July were for biotechs.

Healthcare was also strong in July with five deals raising $515m. One of the biggest raises of the month was the $200m for Flo Health, a fertility tracking app. The Series C was backed by General Atlantic and valued the business at more than $1bn post money. Its last round was a Series B of $50m in 2021.

The one AI deal in the month was substantial with defense AI software business Helsing raising $487m in a round led by General Catalyst valuing the company at $5.4bn. Its Series B round of $223m in September last year was also led by General Catalyst. The post money valuation at that time was c$1.9bn. Helsing develops AI software for weapons, vehicles, and military strategy.

European IPO activity 2022-Q2 2024

Biggest US VC raises in July ($100m and above) – $5.8bn raised

The biggest sector for US raises of $100m and above in July was biotech, with six deals raising a total of $1.07bn. This time AI had to take second place.

There were two deals in the month for AI businesses with legal applications. We include Canada for these purposes with Canadian business Clio raising $900m in the largest deal of the month, led by NEA and GSAM. AI driven legal platform Harvey raised $100m in a deal led by Google Ventures , Open AI and Kleiner Perkins.

There were three Fintech deals with a cumulative value of $442m (Earned Wealth , Aven and Matera). In the month when CrowdStrike received unwanted publicity on a failed security update, three cybersecurity businesses (Vanta $150m at a valuation of $2.45bn), Chainguard ($120m at a valuation of $1.12bn) and Kandji ($100m at a valuation of $850m) raised $370m between them.

Top 30 VC raises by sector - JUly 2024

Europe - $3.6bn of VC raises in June

Our views on the state of the venture capital markets

The combination of global inflation, rising interest rates, and increased geopolitical risk substantially impacted the venture capital market in 2022 and 2023. As we move through 2024 adaptation to the ‘new normal’, the refocusing of venture backed companies to achieve a better balance of growth, profitability and cash flow and the prospect of H2 interest rate cuts have led to increased optimism and enthusiasm for growth equity. Our summary of the outlook is:

- The deterioration in the interest rate, inflation and macro-economic environment has had a sharp impact on valuations in private markets. The scale of the fall in the Refinitiv VC index in 2022 was much more substantial than the 33% fall on NASDAQ. This was reflected in some big valuation reductions in some high-profile VC rounds in 2023.

- There is substantial interest in venture capital to fund artificial intelligence, both the foundation LLM models, the applications of AI and industries (data centres, semiconductors) supporting the development of AI.

- Best-in-class companies, addressing critical requirements, continue to attract support. There are still hotspots for investment most notably in Artificial Intelligence and Climate Tech. Certain investors remain very active in the space with substantial funds to deploy.

- The speed of the investment process has slowed considerably. The level of diligence on new deals has stepped up.

- 2023 saw more downrounds, albeit the substantial fund raising of 2021 and the ability of companies to eke out existing resources has limited the number of these. These continue into 2024.

- There is substantial dry powder in the VC industry. This though appears to be prioritised to support existing rather than new investments.

- It seems likely that the more difficult conditions for fundraising, and the lack of a clear path in some cases to early cash positive status, will mean a flurry of venture capital backed businesses looking to sell or merge their businesses.

- Valuation priorities have shifted with investors having moved away from an emphasis on revenue growth and revenue multiple emphasis. There is a sharp focus instead on profitability (or a rapid path to it), on positive free cash flow and an emphasis on DCF and comparative based multiples.

Read the previous editions:

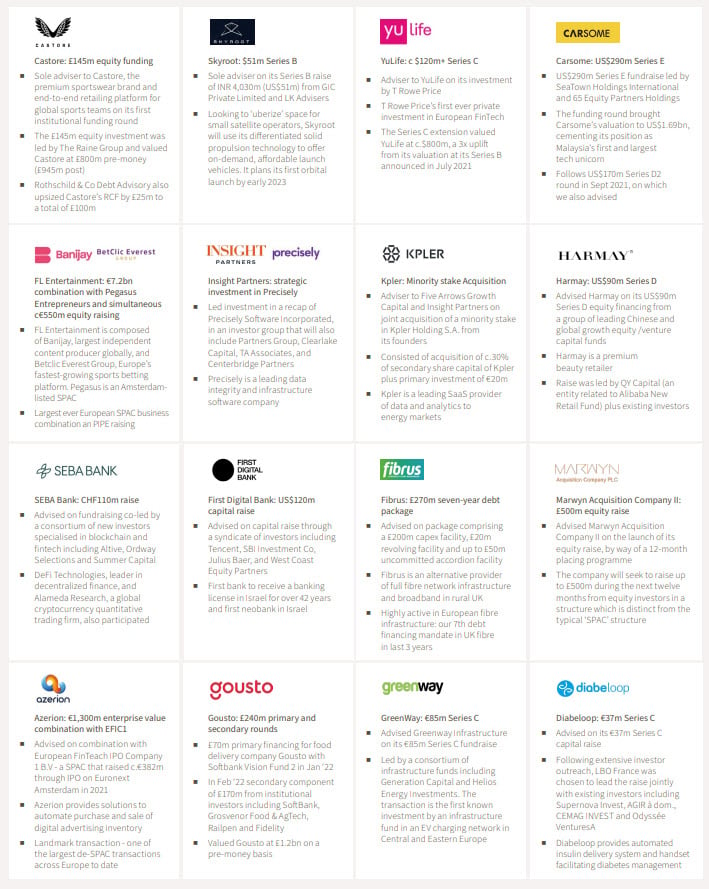

Rothschild & Co: Selected recent deals in Growth Equity and Private Capital

A selection of recent deals on which we have advised

For more information, or advice, contact our Growth Equity team:

Chris Hawley

Global Head of Private Capital

chris.hawley@rothschildandco.com

+44 20 7280 5826

+44 7753 426 961

Patrick Wellington

Vice Chairman of Equity Advisory

patrick.wellington@rothschildandco.com

+44 20 7280 5088

+44 7542 477 291

Mark Connelly

Head of North American Equity Market Solutions

mark.connelly@rothschildandco.com

+1 212 403 5500

+1 917 297 5131

Stéphanie Arnaud

Managing Director – France

stephanie.arnaud@rothschildandco.com

+33 1 40 74 72 93

+33 6 45 01 72 96

This document does not constitute an offer, inducement or invitation for the sale or purchase of securities, investments or any of the business or assets described in it.

This document has been prepared from publicly available information. This information, which does not purport to be comprehensive, has not been independently verified by us or any other party. The document does not constitute an audit or a due diligence review and should not be construed as such. The information provided should not be relied on for any purpose and should not in any way serve as a substitute for other enquiries and procedures that would (or should) otherwise be undertaken.

No representation or warranty, expressed or implied, is or will be made and, save in the case of fraud, no responsibility or liability is or will be accepted by us, as to or in relation to the accuracy, sufficiency or completeness of this document or the information forming the basis of the document or for any reliance placed on the document by any person whatsoever. No representation or warranty, expressed or implied, is or will be made as to the achievement or reasonableness of, and no reliance should be placed on, any projection, targets, estimates or forecasts and nothing in this document should be relied on as a promise or representation as to the future.

Law or other regulation may restrict the distribution of this document in certain jurisdictions. Accordingly, recipients of this document should inform themselves about and observe all applicable legal and regulatory requirements. This document does not constitute an offer inducement, or invitation to sell or purchase securities or other investments in any jurisdiction. Accordingly, this document does not constitute a Financial Promotion under the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 or equivalent legislation in other jurisdictions. This document is being distributed on the basis that each person in the United Kingdom to whom it is issued is reasonably believed to be such a person as is described in Article 19 (Investment professionals) or Article 49 (High net worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 or is a person to whom this document may otherwise lawfully be distributed. In other jurisdictions, this document is being distributed on the basis that each person to whom it is issued is reasonably believed to be a Professional Investor as defined under the local regulatory framework. Persons who do not fall within such descriptions may not act upon the information contained in this document.