Stimulus revives risk appetite

Investment Communications Team, Investment Strategy Team, Wealth Management

Summary

Global equities moved higher by 2.3% in September (USD terms), while global government bonds returned 1.1% (USD, hedged terms). Key themes included:

- Global stocks rise to all-time highs, as China unveils new stimulus measures;

- The US Federal Reserve begins its easing cycle with a larger-than-expected cut;

- Conflict in the Middle East escalates, despite growing calls to end hostilities.

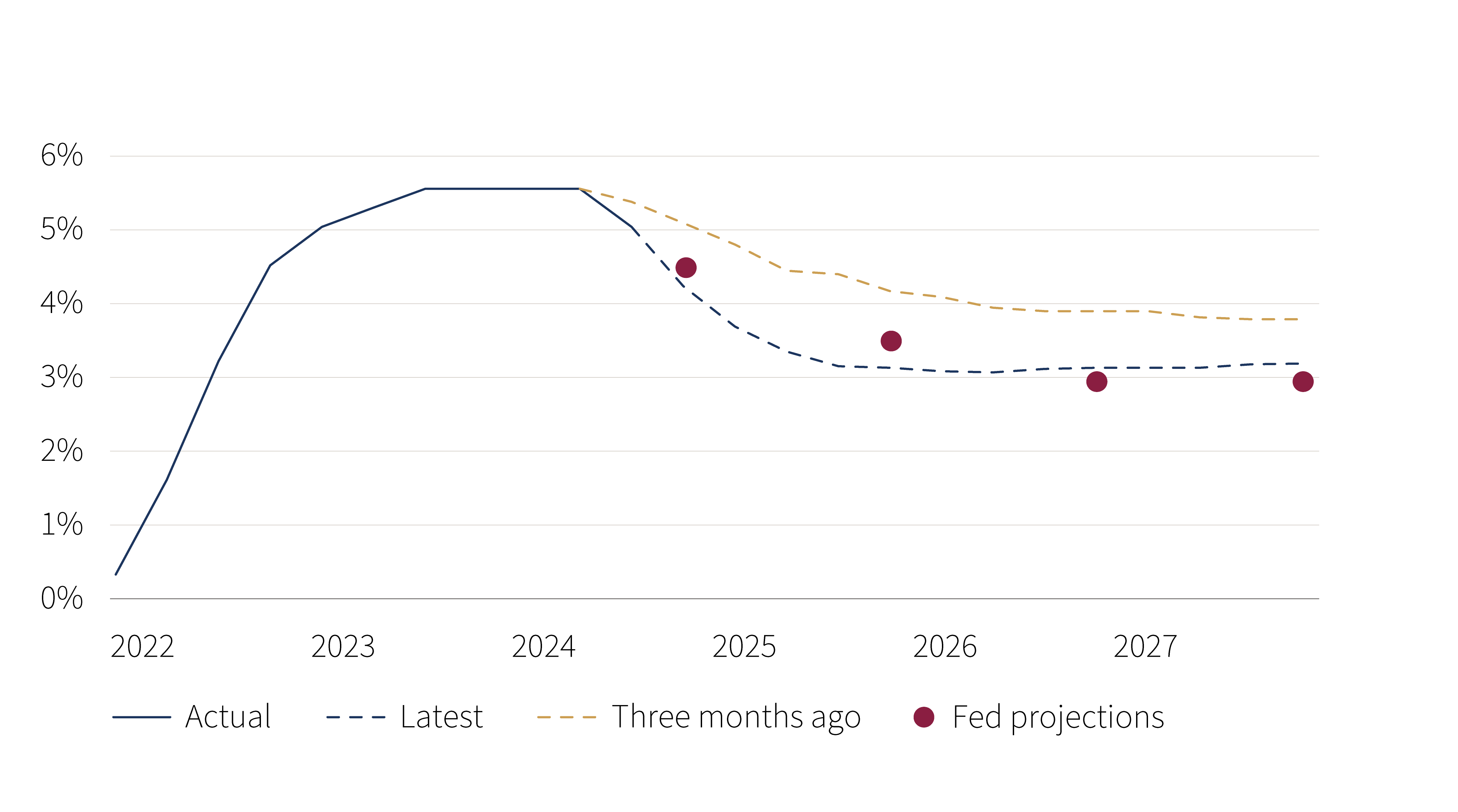

Key chart: US interest rate pricing evolution

Actual (bold) and market-implied (dotted) rate

Source: Rothschild & Co, Bloomberg

Markets: Renewed appetite for China

Global stocks rose to fresh highs yet again, as the major central banks continued to ease their respective policy rates. The US mega-cap names regained momentum, following lacklustre returns in July and August. China’s stock market surged by almost a quarter (in US dollar terms), after authorities committed to further monetary and fiscal support towards the end of September. In fixed income, 10-year US government bond yields declined again, briefly touching a year-to-date low of 3.6%. The US yield curve ‘uninverted’ as shorter-dated government bond yields fell more sharply (than longer-dated bonds). In FX markets, the major currencies continued to appreciate against the US dollar. There was also broad-based strength in commodities – gold notched another new high in US dollar terms – though Brent Crude oil continued to soften, falling below the $70 mark momentarily.

Economy: Resilience and disinflation

US hard data remained upbeat, with both retail sales and industrial production expanding in August. Labour market dynamics appeared more mixed: the pace of job gains was weaker than anticipated again, though the unemployment rate edged lower to 4.2% and initial jobless claims fell to their lowest level in four months. Overall, US output was still tracking at an above-trend pace for the third quarter. The US headline inflation rate fell to 2.5% (y/y) in August, its lowest reading since early 2021. Core inflation remained at 3.2%, largely due to the sticky services CPI component. Eurozone economic data were generally more subdued. The Composite PMI, a timely business survey, contracted in September for the first time since the start of the year. UK activity momentum continued, though inflation there was firmer: headline inflation was unchanged at 2.2%, but core inflation rose to 3.6%. Inflation on the continent remained muted: eurozone headline inflation fell below 2%, while Swiss inflation was closer to 1%.

Policy and politics: The Fed starts big; Middle East conflict intensifies

The US Federal Reserve (Fed) reduced its target rate range by a larger-than-anticipated 0.5 percentage points (%pts), to 4.75-5.00%, and signalled further easing ahead. Even so, money markets were still discounting a more dovish trajectory for US interest rate cuts over the near term. In Europe, the European Central Bank and Swiss National Bank both reduced their respective policy rates by 0.25%pts, to 3.50% and 1.00%. The Bank of England remained on hold, with the base rate at 5.00%.

In the geopolitical sphere, hostilities in the Middle East spread to Lebanon, despite calls by Western nations for a ceasefire. Meanwhile, Putin continued to threaten escalation, particularly if Ukraine was permitted to use long-range missiles to strike the aggressor. US politics remained in the spotlight, but it was marred by another assassination attempt on Donald Trump. In the first presidential debate, Kamala Harris appeared to outperform her opposition, though the popular vote polls remained within a margin of error. Congress also passed a temporary funding bill to avert a potential government shutdown. Elsewhere, former EU Brexit negotiator Michel Barnier was announced as the new French PM, while Shigeru Ishiba won the leadership race for. Japan’s ruling Liberal Democratic Party and called a general election for late October.

Performance figures (as of 30/09/2024 in local currency)

| Equity (MSCI indices $) | Month | Year |

|---|---|---|

| Global | 2.3% | 18.7% |

| US | 2.1% | 21.3% |

| Continental Europe ex. Switz. | 0.8% | 12.4% |

| UK | 0.3% | 15.4% |

| Switzerland | -1.2% | 10.4% |

| Japan | -0.6% | 12.4% |

| Pacific ex Japan | 7.4% | 15.1% |

| EM Asia | 8.0% | 21.6% |

| EM ex Asia | 1.5% | 0.4% |

| Fixed income | Yield | Month | Year |

|---|---|---|---|

| Global Govt (hdg $) | 2.85% | 1.1% | 3.8% |

| Global IG (hdg $) | 4.33% | 1.6% | 5.3% |

| Global HY (hdg $) | 7.29% | 1.8% | 9.5% |

| US 10Y ($) | 3.78% | 1.3% | 4.1% |

| German 10Y (€) | 2.12% | 1.5% | 1.3% |

| UK 10Y (£) | 4.00% | 0.3% | -0.1% |

| Switzerland 10Y (CHF) | 0.41% | 0.6% | 3.0% |

| Currencies (NEERs) | Month | Year |

|---|---|---|

| US Dollar | -1.0% | 1.8% |

| Euro | 0.0% | 1.4% |

| Pound Sterling | 1.2% | 5.4% |

| Swiss Franc | -0.2% | -0.7% |

Table note: NEERs under ‘currencies’ are the JP Morgan trade-weighted nominal effective exchange rates

| Commodities ($) | Level | Month | Year |

|---|---|---|---|

| Gold | 2,635 | 5.2% | 27.7% |

| Brent Crude oil | 72 | -8.9% | -6.8% |

| Natural gas (€) | 39 | -2.0% | 20.7% |

Source: Bloomberg, Rothschild & Co.